The 16 Best Money Tips for Hard Working Dads (Like You)

You work hard don’t you? And in return you make money. But is it enough? And are you spending too much without putting any away for the future.

If you’re living paycheck to paycheck, that’s going to catch up on you soon enough. Or if you’re unable to budget and always seem to be dipping into your savings – will that magic pot of money last forever?

What if you’ve come into a bit of money recently, how do you make sure it’s as well invested as possible?

All of these are important questions when your family is relying on your to provide for their needs. Your kids need clothed, fed and the occasional treat. And you want to be able to give them those things.

That’s why I’ve compiled this list of 16 financial tips – so that you can earn more money, keep it for longer and make it work hard for you.

Money Tips: The Breakdown

I’ve organised these tips into four categories:

- Earning money

- Making more money

- Keeping your money

- Making your money work harder

I’m not a financial guru or expert. But I have plenty experience of managing money and making sure my family doesn’t want for anything. I want these tips to be a guide to you or a prompt to change.

I want you to be encouraged to put them into practice and reap the benefits further down the line.

Earning Your Money

Before you do anything with your money, you need to earn it. But which is best: self employed, employed? And are there certain types of jobs to go for and others to avoid? Keep reading if you want to know more:

1. Pick the right career.

I remember being in first year at University. Some of my molecular biology lectures were in the psychology department. In the restrooms, some clever spark had graffiti-ed the toilet paper dispenser with the words:

Psychology Degrees: Please Take One

The message is clear – if you choose a career or vocation that doesn’t pay well, you’re always going to struggle. Medicine, law, engineering and economics degrees all result in higher salaries than creative arts and media subjects (Source: The Times).

2. Choose the Right Employer

What do I mean ‘the right employer’? Confession time: I’ve made some poor career choices in the past. Ultimately it’s worked out great. But in between, I’ve been in some sucky and truly dead-end jobs.

The problem with a salaried position is that your salary is fixed. So your earning potential is fixed. If you work for a government department, you have no means of improving on your salary. Unless you move up the ladder that is. You have one income stream: your salary.

But, if you work for a company that pays you a salary and a performance related bonus, profit share and stock options you’ve just quadrupled your potential income streams.

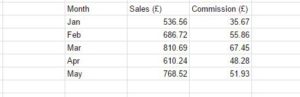

If you work in sales, your commission might be 20-50 percent on top of your basic salary (Source). Now that’s worth having.

Stocks can make you rich. Early employees of Facebook cleaned up because they were partly paid in stock.

3. Can You Make More Money Working for Yourself?

In the UK, around 85% of the workforce is employed by someone else. But at the same time, the number of full time self employed people rose by 25%. (Source: Office of National Statistics).

The drivers towards this self employed exodus are uncertain but the rise of the ‘gig economy’ (where people take advantage of opportunities such as Uber, Upwork and Deliveroo for their main income) is seen as a factor.

Can you make the jump to self employed? More Dads are doing it now than ever before. It’s certainly worth considering isn’t it?

4. Start a Side Hustle

A ‘Side Hustle’ is a little business or work you do along side your regular employment. Most people would think about online business as a side hustle but you could just as easily be a personal trainer, dog walker or even work in a bar.

Since I was a student, I’ve had a side hustle going (before it was called that, I might add) including:

- Flyer guy at music gigs

- Selling Christmas trees

- Doing forestry and tree surgery work

- Self-employed debt collector

Plus a few more.

The advantage with a side income is that you can cream that extra income right off into savings or investments (more on this later).

My current main hustle is affiliate marketing through a couple of websites I own. These bring in a modest regular income each month.

I also wrote the most important book on fatherhood this year.

Making More Money

So you’re earning. So how do you make more money with the same amount of time? And are the simple ways to focus your time and efforts into making you an efficient money making machine? Keep reading if you want the answers.

5. Avoid Working by the Hour

Want to know the problem with being paid £1000 an hour? The maximum amount of money you can make in one day is £24,000. Not bad work if you can get it, but no one can go flat out 24/7/365.

Selling your work for time isn’t scaleable. But what does ‘scaling’ mean (hint: it’s got nothing to do with fish or weighing yourself).

This is the point at which I’d quote a popular article with a definition of scaleability. Except they all suck. No one cares about “the potential to multiply revenue with minimal incremental cost.”

We want to make money over here, not play Scrabble.

Let’s say you wash cars and charge by £5 hour. It takes you half an hour to wash one car.

Then you start charging £5 per car. Now you’re scaling because you’ve doubled your money: 2x cars in one hour at £5 each works out at £10 per car.

But you’re not finished. You employ one of your mates to wash cars at £5 each and you pay him £5 per hour. So for every 2 cars he washes, you make an extra £5.

That’s scaleability. If you can find a job or a business that doesn’t depend on you being around to make money, then you’re golden.

Otherwise, enjoy the 9-5.

6. Start Scaling ‘You Inc’

There’s nothing that I can write in here that isn’t in this article. The basic premise is this: Whatever you know about, make money from that. I know a lot about building professional networks and how to write good.

I also know a lot about supplements and sports nutrition. So guess how I make my money? (hint: it’s not by giving lifestyle advice to Dads.)

7. Change your Income, Change Your Job

If you work a day job, what is the fastest way to increase your income? If you answered ‘rob a bank’, you’re a bad, bad man.

The real answer is this:

Get a job that pays better than the one you’re in.

Makes sense doesn’t it? But it might not just be as simple as all that. If you’re prepared to play the long game, the right career move could set you up for life.

8. Have Multiple Streams of Income

I read recently in James Altucher’s new book Reinvent Yourself that the average multi-millionaire has 7 separate streams of income. And that’s just an average. Clearly many of them have many more!

So it makes sense for you to do the same. But how? Here are a few ideas:

- Start a side hustle (see above)

- Invest in a property rental/real estate

- Get a second job and put that money in income generating investments

- Rent out part of your house (AirBnB just keeps growing)

If you don’t know what or how you can make multiple streams of income this handy Online Business Idea Generator will help.

Even if this cool app doesn’t give you that eureka moment, it will get the ideas flowing. After playing with it to research for this article, I went out on my bike and had an awesome business idea.

The trick with having additional sources of income is not spending it on your lifestyle but leveraging it so that it makes you more money. Which leads us nicely onto the next section which is….

Keeping Your Money

In the 1980’s the singer Whitney Houston was the biggest star on the planet. The movie ‘The Bodyguard’ grossed over $400 million and she signed a record deal with Sony worth $100 million.

But 30 years later, at the time of her death, Houston’s net worth had spiralled to negative 20 million dollars (Source).

It safe to say that Whitney Houston was as good as losing money as she was making it. This should be a cautionary tale to all of us: it doesn’t matter how much you make, it’s how much money you keep that matters.

9. Decide How Much you Can Save/Invest

This is crucial to your approach to saving. Straight-up, you need to figure out how much you can afford to save. There’s no hard and fast rule for this – 5%, 10%, 2% (2 pecent? Really???).

My rule of thumb is that it should hurt a teeny little bit. If you don’t notice the money going out, then you probably aren’t saving enough.

Right now I’m at about 12% across all savings and investments. That’s just the right amount for now but if my circumstances changed for the better, I’d have no issue putting that number higher.

10. Make a Habit of Saving

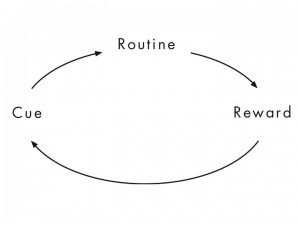

Do you know what a habit is? It’s something you do regularly. The habit loop devised by a study at MIT broke this loop into three stages: Cue, Routine, Reward.

Sounds great. But how do you make this fit into saving your money regularly?

Step 1: As soon as you get paid (Cue), put your designated amount into your chosen savings or investments (Routine).

Step 2: Check your investment or savings accounts to see the money go in. You could keep track of how much is in there with a nice graph or chart (Reward).

For more on the subject, check out Charles Duhigg’s blog and book.

Best Money Tips for Dads: Making Your Money Work Harder

So you’re making good money with a bit of surplus and you’ve cracked the habit of saving daily. Now what?

You want your money to work as hard as possible. The problem is most finance listicles have basic advice like

- Open a cash ISA

- Pay off credit card debt

And so on.

That’s all good advice, but what (if like me) you want to go deeper. I have no intention of having to work until 65, 66, 67… But I may choose to.

And if I’m going to realise that vision, that means putting my money to work. And I’m not talking about having it sit behind the florist’s counter.

My cash is sentenced to thirty years hard labour. Here’s what I mean.

11. Harness the Power of Compounding

Compounding interest is a wonderful thing. You really can double or even triple your money with just a modest rate of interest. But how does it work? Here’s my simple (ish) explanation.

In year one you have £1000 and you get 3.5% interest. This means that by year two, you have £1035. By year three you have £1071.22 until year six you have £1108.71.

Check out what happens to £1000 over these three interest rates:

This graph shows what can happen to your investments over a ten year period. Notice how the 11.5% return nearly tripled the original investment of £1000.

Compounding looks slow to begin with but if you’re prepared to play the long game, you can turn a modest sum into some big gains – provided you can protect them against inflation (this reduces the value of your investments over time).

12. Invest in the Markets

Investing in the stock and bond markets isn’t just for investment pros or even the avid armchair investor. (I’ve bought investments from my armchair. And my sofa. And I bought gold while it bed one time.)

You can easily invest in the stock market through mutual funds. These are funds that group lots of shares or bonds together (a share is a little slice of a company like Apple, a bond is a loan that you buy and get the interest).

I use the fund supermarket Fidelity for all my personal investing because they have a good online platform and relatively low charges. That’s not an ad, just an honest recommendation.

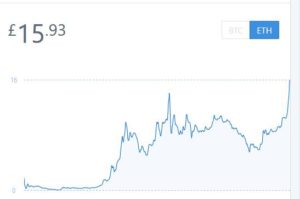

13. Buy Some Bitcoin

If you don’t own any Bitcoin, where have you been for the last nine years? OK, so it’s a massive risk seeing as you’re basically buying a ‘Well Done’ sticker for a computer that’s good at maths. And then cutting it up into tiny pieces and then selling them on or using them to buy stuff.

You could also buy Ethereum which is a bit like Bitcoin but different. I explained what it is in really simple language here.

This link will give you $10 in Bitcoin when you invest $100. Oh and I get ten bucks too so everyone wins.

The collective name for these types of digital currencies is ‘crypto currency’ which has to be the dorkiest name for anything, ever. Don’t expect to see it written on this website again.

14. Invest in Index Linked Funds

So you’ve bought your $100 in Bitcoin and you’re now ready to invest in the stock market. So you sign up for Fidelity (or another provider).

Where or where do you invest your hard earned money? Do you find the most successful fund and put your cash in there (I used to do this). Or is there another way?

Here’s the thing you won’t read in the Times Money supplement – few ‘managed’ funds beat the market over time. And good luck finding the ones that do.

Most managed funds will charge you a hefty management fee, up to 1.5% of your total amount invested. So if you had £1000, your fund manager gets £15. Doesn’t sound like much. But there are two BIG problems with this:

- He makes money even if you don’t. Yes, you read that right. If the market plummets and your fund manager loses 25% of your cash, guess who still gets paid his 1.5%?

- Big charges eat away at your returns. Trust me on this (or do the sums yourself) – the difference between a 4% return and a 5.5% return over 20 years (remember compounding?) is mahoosive:

Thankfully there’s an alternative that’s cheaper and performs well: Index linked funds. These allow you to buy across a whole index (the FTSE 100 is an index, so is the S&P 500). Then when the market’s up, you’re up too.

The charges are generally low, normally a fraction of 1 per cent. Don’t believe me? Here’s what the UK finance site This is Money had to say:

“The accumulating effect of annual charges is startling. Invest £10,000 and apply 6 per cent annual growth over 10 years:

- with a 1.5 per cent charge it will grow to £16,929;

- with a 0.25 per cent charge it will grow to £19,185.”

15. Cost Average into the Markets

So you’ve got your index linked fund set up and you’ve decided to invest 8% of your post tax salary (smart move, you’ve been paying attention). What’s the best way to do this?

Cost averaging.

This is a complicated term for ‘buying a little bit each month’. Cost averaging means you buy when the market is high and low. The result is you get a better return on average than if you invested it all at once or tried to ‘ride’ the market.

There are a gazillion videos on cost averaging on YouTube.

16. Read a Book

No, not just any book. Read this book:

There are few other books that changed my thinking on personal finance as much as this, apart from this one.

I bought the Kindle edition but I’d recommend buying the paperback and taking notes/buying lots of book marks. It might be the most important £10 you spend.

Sure, some of it’s a bit scammy and Robbins really wants you to download his app. But when you cut through all of that, there’s an incredible wealth of knowledge and information there.

Here’s an example:

Robbins interviews the top experts in finance. One gives him THE ULTIMATE WAY TO PROTECT ALL YOUR MONEY RIGHT NOW. (It’s possible I’m paraphrasing but when Tony speaks to me, it’s always in CAPS.)

It’s basically a way to divide up your investments eg: 30% stocks, 40% bonds, 6% gold etc.

Bonus Tip: Teach Your Kids How to Speak Money

How often do you hear this?

“Schools should teach kids more about money.”

WRONG!

Fathers should teach kids more about money. Before Dads spent their free time watching Netflix boxsets, we used to teach our children about life. Imagine.

A good place to start is teaching your kids where money comes from and how you get more of it.

Teach them how to save up for things like toys they want and reward them financially for doing chores around the house.

The best academic education in the world doesn’t mean Jack if they can’t manage their personal finances. And it’s your job to teach them how.

Best Money Tips for Hard Working Dads: Time to Overhaul Your Finances?

If you’ve read to the end, then firstly, well done. This post took me several hours to write and research so hopefully the last eleven and a half minutes were enlightening.

If you’ve read this and are now determined to give your finances a facelift then great.

But how do you make sure they are more Tom Cruise than Mickey Rourke?

My advice would be to start slowly and small and build up your knowledge. If you see some word or term you don’t understand, research it until you do.

Read the books mentioned in this post and be prepared to put time into your money.

Think about it as an investment in you and your family’s future.

If you liked this post, you’ll enjoy my new book which is available worldwide on Amazon. Get it here: